Family Insurance Plans in Canada: A Comprehensive Guide to Protecting Your Loved Ones

When it comes to safeguarding your family’s future, choosing the right insurance plan is crucial. Family insurance plans in Canada offer comprehensive coverage to protect your loved ones in times of need. Whether you’re looking to cover health, life, or specific medical needs, this guide will help you understand the available options to find the best plan that suits your family’s requirements.

What Are Family Insurance Plans?

Family insurance plans are comprehensive policies that provide coverage to all family members under a single plan. These plans can include a variety of insurance products, such as:

- Health Insurance: Coverage for medical expenses, including hospital visits, doctor consultations, and prescription drugs.

- Life Insurance: Financial protection for your family in case of the policyholder’s death.

- Dental and Vision Insurance: Plans specifically designed to cover dental check-ups, treatments, and vision care.

- Critical Illness Insurance: Coverage for life-threatening illnesses like cancer, heart disease, or stroke.

- Travel Insurance: Protection for medical emergencies when traveling outside of Canada.

Why Choose Family Insurance Plans in Canada?

Choosing a family insurance plan in Canada has numerous benefits:

- Cost-Effective: It is often more affordable to purchase a family plan rather than individual plans for each family member.

- Simplified Management: Managing a single policy is easier than handling multiple individual policies.

- Comprehensive Coverage: These plans offer wide-ranging benefits, ensuring that each family member gets the necessary protection.

- Flexibility: Many plans can be tailored to suit the specific needs of your family.

Top Family Insurance Providers in Canada

Here are some of the leading insurance providers in Canada that offer excellent family insurance plans:

- Manulife

- Overview: Manulife is one of Canada’s largest insurance providers, offering a variety of family insurance plans, including life, health, and dental coverage.

- Website: Manulife Official Website

- Sun Life Financial

- Overview: Sun Life Financial provides extensive family insurance options, including critical illness and comprehensive health plans.

- Website: Sun Life Financial Official Website

- Canada Life

- Overview: Canada Life offers customizable family insurance plans that cater to the unique needs of Canadian families, with options for life and health insurance.

- Website: Canada Life Official Website

- Desjardins Insurance

- Overview: Known for its competitive rates and comprehensive coverage, Desjardins offers family health and life insurance plans that are ideal for Canadian households.

- Website: Desjardins Insurance Official Website

Factors to Consider When Choosing a Family Insurance Plan

- Coverage Options

- Ensure the plan covers all essential areas such as health, life, dental, and vision care.

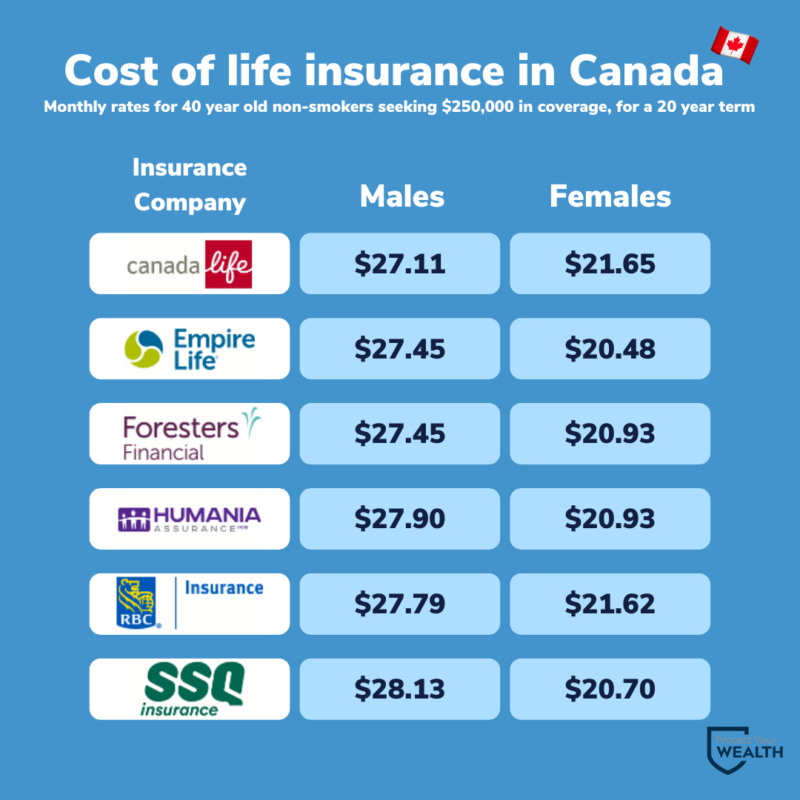

- Premium Costs

- Compare the monthly premiums of different plans to find one that fits your budget.

- Policy Flexibility

- Look for plans that allow you to add or remove members without a significant increase in cost.

- Exclusions and Waiting Periods

- Review the policy’s exclusions and understand any waiting periods that may apply to specific benefits.

Benefits of Family Insurance Plans in Canada

- Financial Security: Provides peace of mind knowing that your family is protected against unforeseen expenses.

- Access to Quality Healthcare: Ensures that your loved ones receive timely medical attention without financial strain.

- Support in Critical Times: Offers support in case of serious health issues or life-threatening situations.

How to Apply for Family Insurance Plans in Canada

Applying for a family insurance plan in Canada is simple:

- Research: Compare different insurance providers and their plans.

- Get a Quote: Visit the official websites of the providers listed above to get a quote tailored to your family’s needs.

- Consult an Insurance Agent: Speak with an insurance agent to understand the best options for your family.

- Purchase the Plan: Once you’ve chosen a plan, complete the application process on the insurer’s official website.

Conclusion

Family insurance plans in Canada provide a comprehensive and cost-effective way to protect your loved ones from unexpected expenses. By choosing the right plan, you can ensure financial security, access to quality healthcare, and peace of mind. Be sure to compare different policies and choose one that best meets your family’s needs.

For more detailed information and to explore your options, visit the official websites of Manulife, Sun Life Financial, Canada Life, and Desjardins Insurance.