Understanding Loans in Canada: Your Comprehensive Guide

Navigating the world of loans can be daunting, especially for those new to the financial landscape in Canada. Whether you’re looking to purchase a home, finance your education, or consolidate debt, understanding the different types of loans available is crucial. This guide will walk you through the various loan options in Canada, their features, and how to secure one that meets your needs.

1. Types of Loans Available in Canada

a. Personal Loans

Personal loans are unsecured loans that can be used for various purposes, such as consolidating debt, covering unexpected expenses, or funding a major purchase. These loans typically have fixed interest rates and repayment terms ranging from 1 to 7 years.

b. Mortgages

A mortgage is a specific type of loan used to purchase real estate. In Canada, mortgage terms can vary, with fixed and variable interest rates available. Mortgages usually require a down payment, and the amount you can borrow depends on your credit score and income.

c. Student Loans

If you’re pursuing higher education, you may qualify for federal or provincial student loans. These loans often have lower interest rates and flexible repayment options. The Canada Student Loan Program (CSLP) offers financial assistance to eligible students, making education more accessible.

d. Auto Loans

Auto loans are designed for purchasing vehicles. These loans can be secured through banks, credit unions, or dealerships. The loan amount typically covers the vehicle’s purchase price, and repayment terms can range from 2 to 7 years.

e. Business Loans

For entrepreneurs, various business loan options are available, including term loans, lines of credit, and government-backed loans. The Canada Small Business Financing Program (CSBFP) is a popular choice for new and existing businesses looking for funding.

2. How to Qualify for a Loan

Qualifying for a loan in Canada typically involves the following steps:

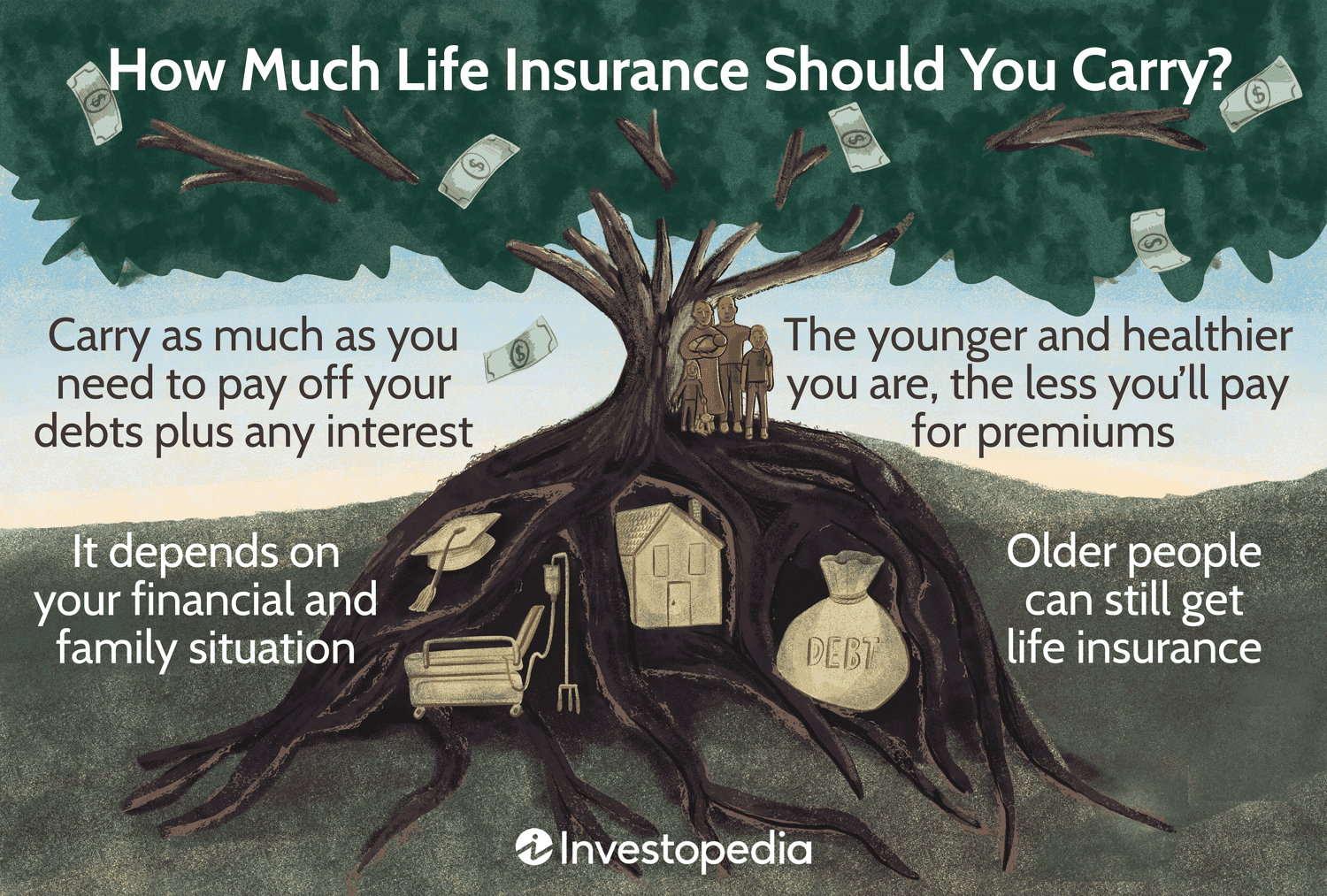

- Check Your Credit Score: Lenders assess your creditworthiness based on your credit score. A higher score increases your chances of approval and may secure better interest rates.

- Assess Your Debt-to-Income Ratio: Lenders look at your income compared to your monthly debt payments. A lower ratio indicates that you can manage additional debt responsibly.

- Provide Necessary Documentation: Be prepared to submit documents such as proof of income, employment verification, and identification.

- Choose the Right Lender: Research different lenders to find one that offers favorable terms and interest rates. Consider traditional banks, credit unions, and online lenders.

3. The Loan Application Process

Applying for a loan in Canada generally follows these steps:

- Research and Compare: Investigate various loan options, interest rates, and terms from multiple lenders.

- Pre-Approval: Some lenders offer pre-approval, which gives you an idea of how much you can borrow and at what rate.

- Submit an Application: Complete the loan application and provide the required documentation.

- Loan Approval: Once your application is reviewed, the lender will inform you of their decision. If approved, you’ll receive a loan agreement outlining the terms.

- Receive Funds: After signing the agreement, the funds will be disbursed to you or directly to the seller (in the case of mortgages or auto loans).

4. Tips for Managing Your Loan

- Make Payments on Time: Timely payments can help maintain a good credit score and avoid penalties.

- Consider Automatic Payments: Setting up automatic payments can help you stay on track.

- Budget Wisely: Incorporate your loan payments into your monthly budget to ensure you can meet your obligations.

Conclusion

Loans can provide the financial assistance you need to achieve your goals, whether it’s buying a home, funding your education, or starting a business. By understanding the types of loans available and the qualification process, you can make informed decisions that align with your financial situation.

For more information on loans in Canada, visit the Government of Canada’s official website on financial literacy here.

SEO Tips

To optimize this blog post for search engines:

- Keywords: Use relevant keywords like “loans in Canada,” “personal loans Canada,” “mortgages Canada,” etc., throughout the text.

- Headers: Use H1, H2, and H3 tags appropriately for better organization and readability.

- Links: Include internal and external links to authoritative sources to enhance credibility.

- Meta Description: Craft a compelling meta description that summarizes the post and includes target keywords.

By following these guidelines, your blog post on loans in Canada can attract readers and rank well on Google.