Medical Coverage in the USA: Everything You Need to Know

Medical coverage in the USA is a critical aspect of the healthcare system, providing individuals with access to necessary medical services without facing exorbitant costs. Whether you are a resident, an immigrant, or just planning to move to the USA, understanding how medical coverage works is essential. In this blog post, we will explore the different types of medical coverage, how to choose the best plan, and provide you with the official resources to help you make informed decisions.

What is Medical Coverage?

Medical coverage refers to health insurance plans that help cover the costs of medical care, including doctor visits, hospital stays, prescription medications, preventive services, and more. It protects individuals from high healthcare expenses by reducing out-of-pocket costs and ensuring that they have access to necessary medical treatments.

Types of Medical Coverage in the USA

The USA offers various types of medical coverage, including:

- Private Health Insurance

- Employer-Sponsored Insurance: Most Americans receive medical coverage through their employers. Companies offer a variety of plans, often sharing the cost of premiums with their employees.

- Individual Health Insurance: Individuals can purchase private health insurance plans through marketplaces like the Health Insurance Marketplace. These plans are ideal for those who are self-employed, unemployed, or whose employers do not offer health coverage.

- Government-Sponsored Health Insurance

- Medicare: A federal health insurance program for people aged 65 and older or those with specific disabilities. Medicare is divided into four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

- Medicaid: A state and federal program providing free or low-cost health coverage to low-income individuals and families. Eligibility for Medicaid varies by state and is based on income levels.

- Children’s Health Insurance Program (CHIP): CHIP provides low-cost health insurance to children in families who earn too much money to qualify for Medicaid but cannot afford private insurance.

- Veterans Affairs (VA) Health Care: Health coverage for veterans who have served in the military, providing access to a range of medical services through VA medical facilities.

How to Choose the Right Medical Coverage

Choosing the right medical coverage depends on several factors, including your budget, healthcare needs, and eligibility. Here are some steps to help you decide:

- Assess Your Healthcare Needs: Consider how often you visit doctors, your current health condition, and any medications you take. If you have a chronic illness, you might need a plan that offers extensive coverage.

- Compare Plans: Use the Health Insurance Marketplace to compare different plans based on coverage options, premiums, out-of-pocket costs, and provider networks. You can also see if you qualify for subsidies to help lower your premium costs.

- Check Provider Networks: Ensure that your preferred doctors and hospitals are part of the insurance plan’s network to avoid higher costs for out-of-network care.

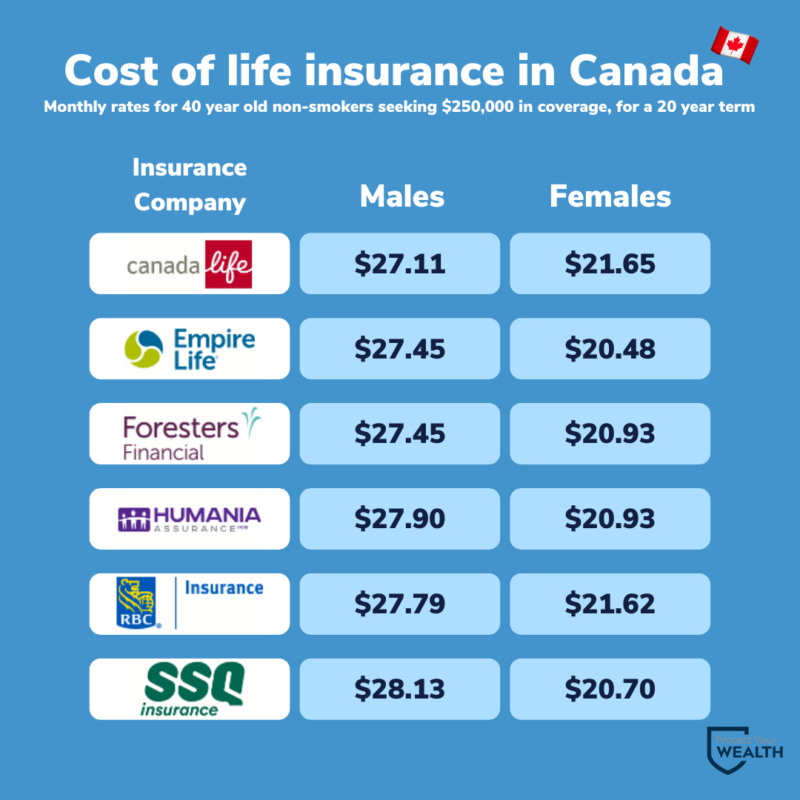

- Consider the Costs: Look beyond the monthly premiums and consider other costs like deductibles, co-pays, and co-insurance. A plan with a low premium might have higher out-of-pocket expenses.

Benefits of Having Medical Coverage in the USA

- Financial Protection: Medical coverage protects you from unexpected and high medical costs, ensuring that you don’t drain your savings during a health crisis.

- Access to Quality Care: Having insurance enables you to receive regular check-ups, preventive care, and necessary treatments without delays.

- Prescription Drug Coverage: Most health insurance plans include prescription drug coverage, reducing the cost of medications.

- Preventive Services: Many plans offer free preventive services like vaccinations, screenings, and wellness visits to help you stay healthy.

Official Resources for Medical Coverage in the USA

For more detailed information and to explore your options, visit the official websites:

- Health Insurance Marketplace: HealthCare.gov

- Medicare: Medicare.gov

- Medicaid and CHIP: Medicaid.gov

These official resources provide comprehensive information about available plans, eligibility criteria, and how to apply for medical coverage in the USA.

Conclusion

Medical coverage in the USA is essential for safeguarding your health and financial well-being. Whether you opt for private health insurance or qualify for government-sponsored plans, understanding your options is the key to making the best choice. By assessing your healthcare needs, comparing plans, and using official resources, you can find a medical coverage plan that fits your lifestyle and budget.

Do you have any questions about medical coverage in the USA? Feel free to leave a comment below!