Personal Insurance in the UK: A Comprehensive Guide for 2024

When it comes to safeguarding your future, personal insurance is a crucial component of financial planning. In the UK, there are various types of personal insurance options designed to provide financial protection in times of need. This guide will walk you through everything you need to know about personal insurance in the UK, helping you make informed decisions about your coverage.

What is Personal Insurance?

Personal insurance refers to a range of policies that offer financial protection for individuals against unexpected events. It typically includes life insurance, health insurance, income protection, and other policies that cover specific risks. These insurance policies help protect you and your loved ones from financial hardship in case of accidents, illnesses, or other life-changing events.

Types of Personal Insurance in the UK

- Life Insurance

- What It Covers: Provides a lump-sum payment to your beneficiaries in case of your death.

- Popular Types: Term life insurance, whole life insurance, and over 50s life cover.

- Why You Need It: To ensure your family is financially secure even after you’re gone.

- Health Insurance

- What It Covers: Covers the cost of private medical treatments, including consultations, surgeries, and other healthcare services.

- Benefits: Faster access to medical care, high-quality treatment options, and reduced waiting times.

- Top Providers: Bupa, AXA Health, and Vitality Health offer comprehensive health insurance plans.

- Income Protection Insurance

- What It Covers: Replaces a portion of your income if you’re unable to work due to illness or injury.

- Why It’s Important: Helps you maintain your lifestyle and manage daily expenses during recovery.

- Coverage Period: Policies can cover short-term or long-term disability, depending on your needs.

- Critical Illness Insurance

- What It Covers: Pays a lump sum if you are diagnosed with a specified critical illness like cancer, heart attack, or stroke.

- Ideal For: Individuals looking to cover medical expenses, mortgage payments, or any financial obligations during recovery.

- Top Features: Tax-free payouts and flexibility in choosing how to use the funds.

- Personal Accident Insurance

- What It Covers: Offers financial support in case of accidental injuries that result in disability or death.

- Benefits: Provides peace of mind knowing that your family will be supported in case of an unforeseen accident.

- Best For: Those with active lifestyles or high-risk professions.

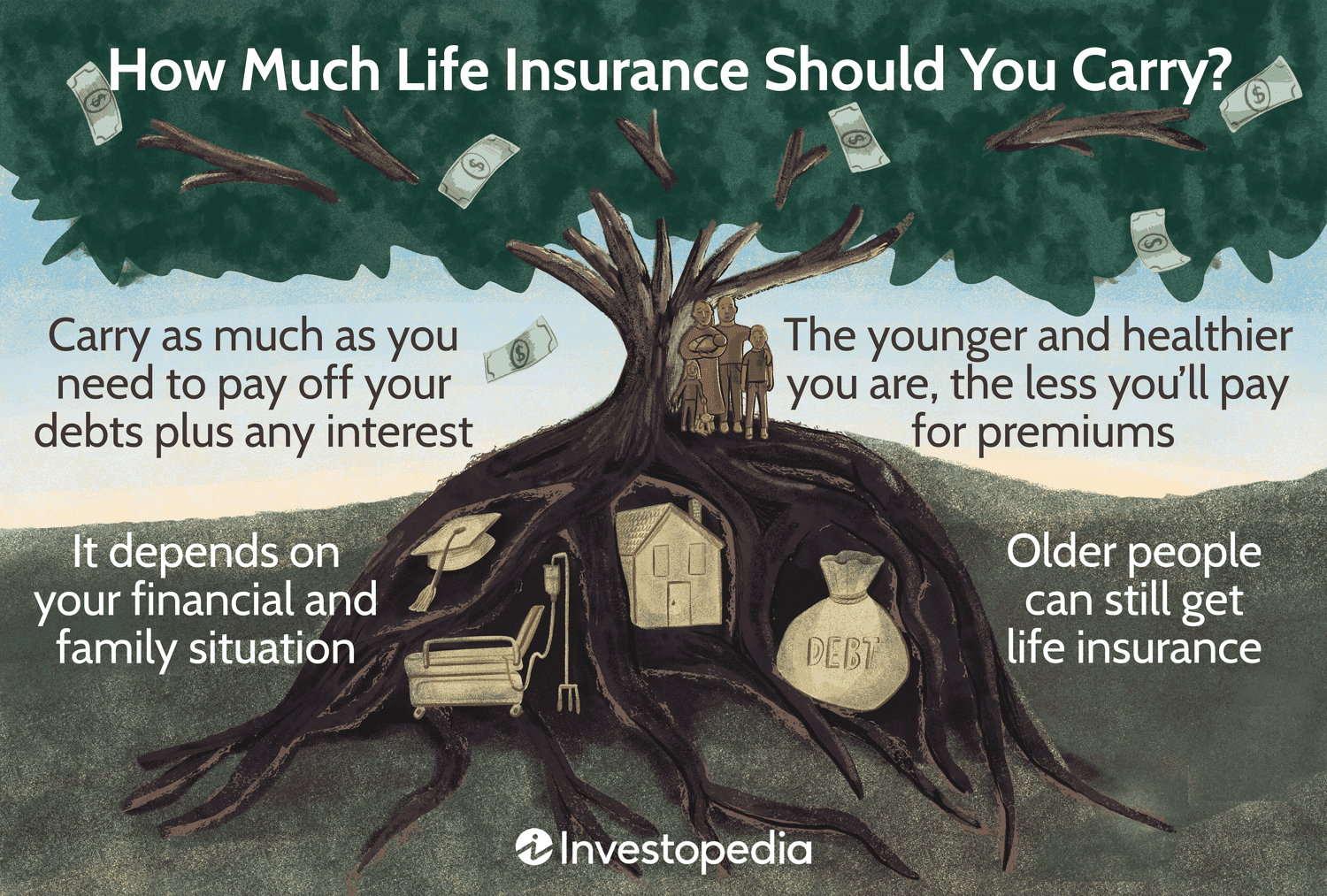

Choosing the Right Personal Insurance Policy

Selecting the right personal insurance policy in the UK can be overwhelming, given the numerous options available. Here are some tips to help you make the best decision:

- Assess Your Needs: Determine the type of coverage that best suits your lifestyle and financial goals.

- Compare Quotes: Use comparison websites like Compare the Market or MoneySuperMarket to get the best deals.

- Check the Insurer’s Reputation: Always choose a reputable insurer with strong customer service and a proven track record of claim settlements.

Benefits of Personal Insurance in the UK

- Financial Security: Provides peace of mind knowing that you’re protected against life’s uncertainties.

- Customizable Policies: Many insurers offer flexible plans that can be tailored to meet individual needs.

- Tax Benefits: Certain policies come with tax advantages, which can help reduce your overall tax liability.

Top Personal Insurance Providers in the UK

- Aviva

- Website: Aviva Official Site

- Why Choose Them: Known for their comprehensive policies and excellent customer service.

- Legal & General

- Website: Legal & General Official Site

- Specialty: Offers a wide range of life and health insurance plans suitable for different needs.

- AXA

- Website: AXA Official Site

- Features: Provides competitive rates and tailored insurance solutions.

FAQs About Personal Insurance in the UK

1. Is personal insurance mandatory in the UK?

- No, personal insurance is not legally required, but it is highly recommended for financial security.

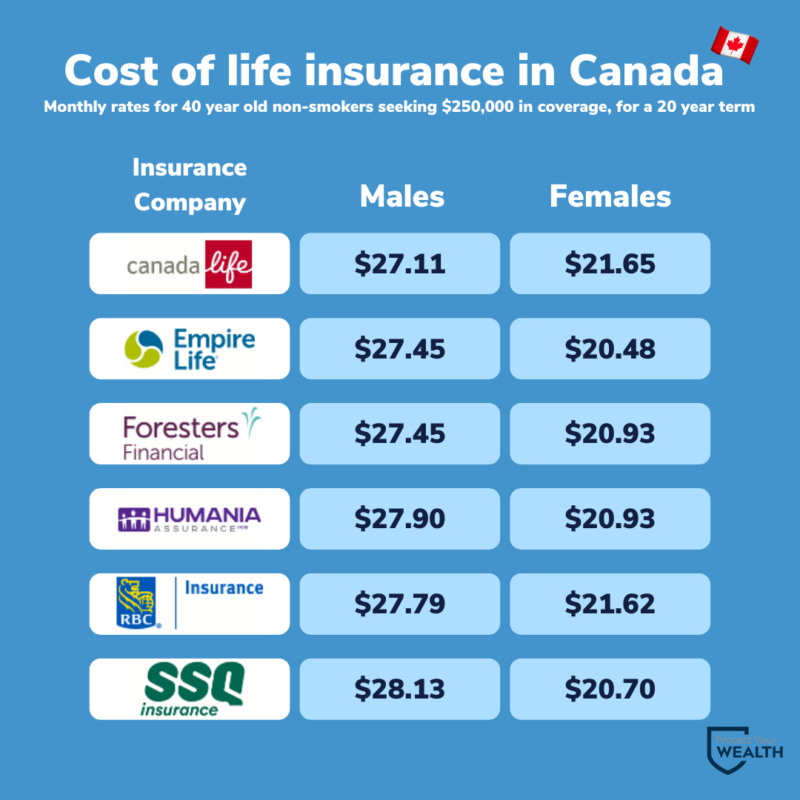

2. How much does personal insurance cost in the UK?

- The cost varies based on factors such as age, health, lifestyle, and the type of coverage chosen.

3. Can I get personal insurance with pre-existing conditions?

- Yes, but your premiums may be higher, and some conditions might not be covered. It’s best to consult with your insurer for specific details.

Conclusion

Investing in personal insurance in the UK is a smart way to protect yourself and your family against unforeseen financial burdens. Whether you’re looking for life insurance, health coverage, or income protection, the right policy can make a significant difference in your life. Take the time to research and choose a plan that aligns with your needs and offers you the best value.

For more detailed information and to get personalized quotes, visit the UK Government’s official insurance page or consult trusted insurance providers like Aviva, Legal & General, or AXA.